|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

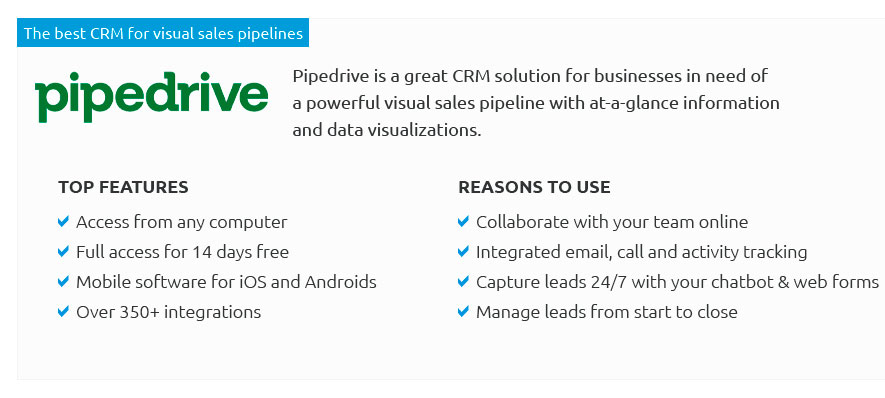

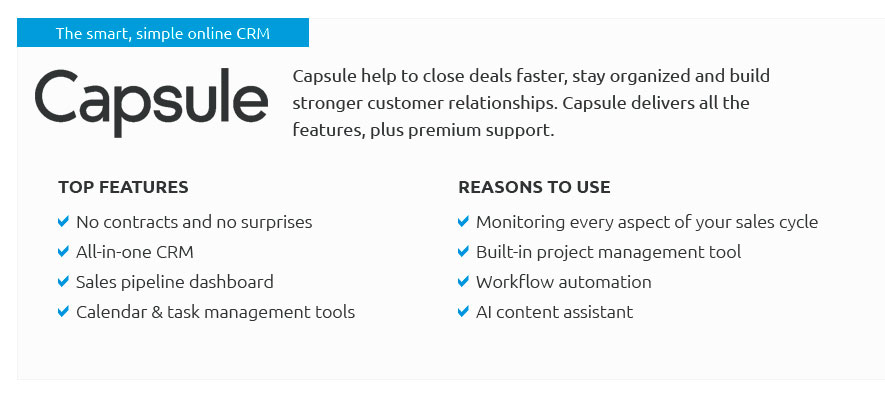

Discover the ultimate game-changer in customer relationship management with our comprehensive CRM software review-uncover the best CRM platforms that are revolutionizing the industry, featuring the unparalleled capabilities of private equity CRM; streamline your investment processes, enhance client interactions, and drive unparalleled growth with cutting-edge tools designed to elevate your strategic edge, all backed by insightful analysis and real-world performance metrics that set you apart from the competition.

https://www.meridian-ai.com/

CRM built for private market investors. Meridian centralizes your deal history and leverages AI to enrich your data and streamline workflows, resulting in firm- ... https://ascendix.com/blog/best-private-equity-crm-software/

The best CRM for private equity is the one tailored to the needs of private equity investors, traders, accounting for long deal cycles, investment contact ... https://www.sugarcrm.com/industries/private-equity/

A CRM system designed specifically for private equity firms revolutionizes how they manage relationships and operations. With a specialized private equity CRM, ...

|